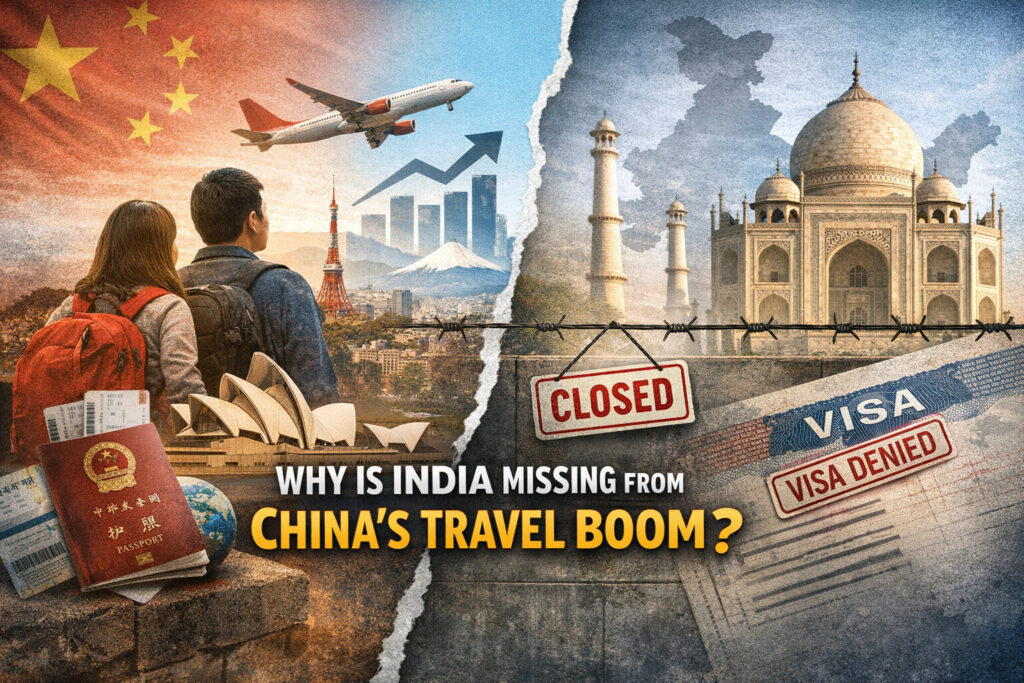

As Chinese travellers ring in the New Year with longer, experience-led holidays, fresh data from Fliggy points to a sharp rebound in outbound travel, higher spending and growing interest in long-haul destinations. Yet amid this renewed global travel momentum, one absence stands out clearly: India does not feature among the preferred destinations for Chinese New Year travellers.

This omission is striking, particularly at a time when destinations across East Asia, Southeast Asia, Europe, the Americas and even emerging markets are seeing strong year-on-year growth from Chinese outbound tourism.

What the Data Says

According to Fliggy’s 2026 New Year Holiday Travel Trends, Chinese travellers are extending short holidays by combining annual leave, driving demand for longer trips and more immersive experiences. Average order values are up, bookings per traveller have increased, and outbound travel has already surpassed last year’s New Year holiday levels.

The report highlights:

- Rising interest in experiential travel, including skiing, themed city breaks and event-led holidays

- Strong growth among young travellers, particularly those born after 2005

- A surge in self-drive international travel

- Growing appetite for long-haul destinations, including the United States and Australia

- Rapid growth in bookings to countries such as Argentina, Nepal, Saudi Arabia, Portugal and Hungary

Yet India remains absent from both the “popular” and “emerging” destination lists.

Is Visa Access the Problem? Not Anymore

A common assumption within the travel industry is that India’s absence from Chinese outbound trends is due to visa restrictions. However, this perception no longer fully reflects reality.

India has resumed issuing visas to Chinese nationals, ending a prolonged suspension that followed the COVID-19 period and geopolitical tensions earlier in the decade. While travel volumes are still rebuilding and processes may not yet be frictionless, visa availability alone can no longer explain India’s invisibility in current Chinese travel patterns.

This distinction is important. It shifts the conversation from policy limitation to market readiness and destination positioning.

So Why Are Chinese Travellers Choosing Elsewhere?

The Fliggy data offers several indirect but telling clues.

1. Clear Experience Narratives Win

Chinese travellers are responding strongly to destinations with clearly defined travel stories — winter tourism, skiing hubs, aurora viewing, self-drive routes, New Year events and family-centric attractions. These themes are easy to understand, easy to market and easy to book.

India, by contrast, continues to be promoted largely as a broad cultural destination, without sharply packaged, theme-based propositions tailored to contemporary Chinese travel behaviour.

2. Connectivity Still Matters

While long-haul travel is growing, destinations benefiting most from Chinese outbound demand offer strong air connectivity, predictable routing and frequent services. Limited direct flights and capacity constraints remain a practical deterrent for leisure travel to India, particularly for short holiday windows.

3. Digital Visibility on Chinese Platforms

Chinese travellers plan, book and validate travel decisions within a tightly integrated digital ecosystem. Destinations that perform well are those with strong visibility on Chinese-language platforms, travel apps and social ecosystems. India’s digital presence in this space remains fragmented and inconsistent.

4. Product Alignment with New Travel Mindsets

Fliggy’s data shows that Chinese travellers are moving away from checklist sightseeing towards memory-driven, personalised experiences — family travel, pet-friendly holidays, curated activities and event-based travel. India’s tourism offerings, though rich, are not yet consistently packaged or marketed in formats that resonate with these evolving preferences.

A Missed Opportunity — and a Strategic Lesson

India’s absence from China’s New Year travel radar should not be read as a lack of interest in India as a destination. Instead, it reflects a gap between India’s tourism potential and how that potential is currently presented to the Chinese market.

The data makes one thing clear: visa access is only the first step. In today’s outbound travel environment, destinations compete on clarity, convenience and storytelling.

For Indian tourism stakeholders — including destination marketers, airlines, tour operators and policymakers — the lessons are timely:

- Outbound recovery does not automatically translate into inbound gains

- China’s travel market is now experience-first, not price-first

- Youth travellers and families are driving future growth

- Digital-native engagement is no longer optional

The Road Ahead

China’s outbound travel recovery offers India a second chance to re-engage one of the world’s most valuable tourism source markets. But capitalising on this opportunity will require coordinated action — improved connectivity, market-specific product development, targeted promotion and sustained presence on Chinese travel platforms.

As global destinations move quickly to capture China’s renewed appetite for travel, India’s current absence should serve as a wake-up call, not a verdict.

The question is no longer whether Chinese travellers can come to India — but whether India is ready to meet them where their travel aspirations now lie.