Following the release of the PATA Executive Summary Forecasts Report for the years 2024 to 2026 released earlier last month, the Pacific Asia Travel Association (PATA) on March 14 released a more comprehensive Asia Pacific Visitor Forecasts 2024-2026 report, taking a deeper dive into growth projections, focusing on the source market-destination pairs from 2024 to 2026 for each of the three Asia Pacific destination sub-regions. This report covers 39 destinations within Asia Pacific forecasting from 2024 up to 2026 in a series of three possible scenarios.

PATA CEO Noor Ahmad Hamid points out that, “While most destinations within the Asia Pacific region are rebounding strongly and moving closer to pre-pandemic levels, this forecast report highlights the significant changes as experienced by the individual destinations. Therefore, it is important to understand this trend which will impact the future growth for respective destinations as compared to the overall region.”

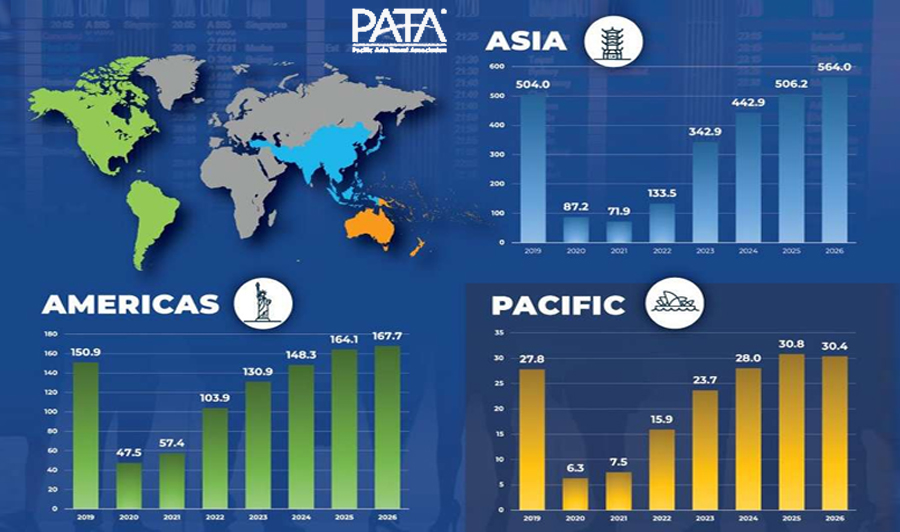

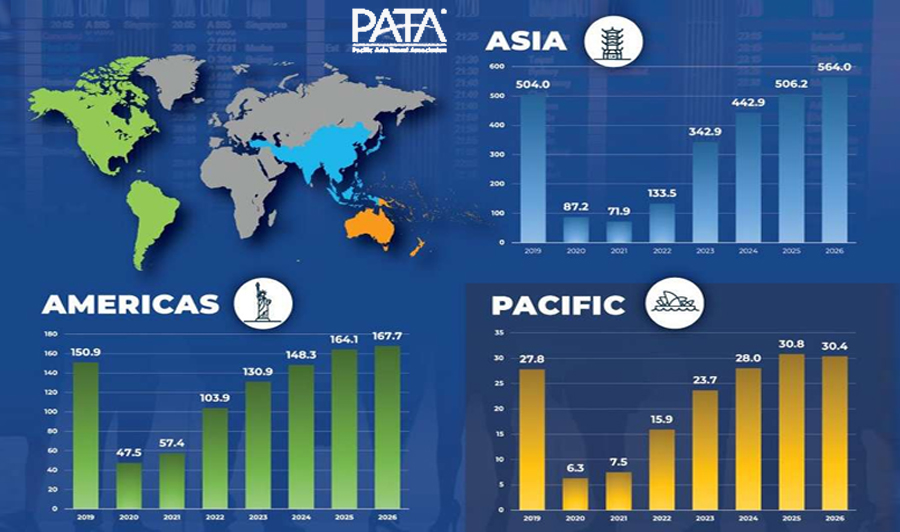

Under the medium scenario, international visitor arrivals (IVAs) to Asia Pacific are expected to increase from 619 million in 2024 to 762 million in 2026, with a recovery rate of 111.6% compared to the 2019 level. Asia will lead the recovery, with visitor arrivals reaching 564.0 million, followed by the Americas with 167.7 million and the Pacific with 30.4 million by 2026, highlighting the region’s resilience and growing potential as a travel destination.

In interpreting the Asia Pacific Visitor Forecasts 2024-2026 report, it is crucial to note that the data should not be viewed holistically, as destinations are undergoing recovery at varying paces. Each destination has its unique dynamics, contributing to diverse percentage changes in international visitor arrivals. For example, while numerous Pacific destinations are experiencing robust recovery, their numerical figures understandably differ in scale when compared to larger destinations globally. In analysing the forecasted growth, it becomes evident that understanding the nuanced recovery patterns of individual destinations is imperative for a comprehensive perspective on the evolving landscape of tourism in the Asia Pacific region. PATA emphasises the significance of observing the specific recovery rates and trends for each destination, as they shape the overall narrative of the region’s tourism resurgence.

Out of 39 destinations covered in the report, 34 are predicted to recover to pre-pandemic levels, with Japan and the Maldives topping the fastest-recovering destinations chart. Japan is forecast to welcome 49.3 million visitors by 2026, which is 155% more than the 2019 number. The Maldives is expected to host 2.5 million visitors, indicating a 148% recovery rate to pre-pandemic levels. With this in mind, the visitor arrivals recoveries in the region call for appropriate destination management strategies.

China, the US, the UK, and Australia are expected to maintain their leading positions as major source markets of IVAs to the Asia Pacific region, all of which are forecast to recover to pre-pandemic levels by 2024, fuelled by their economic growth potentials.

Noor added, “The ramifications for destination marketing organisations (DMOs) to be more agile, flexible and robust to quick changes in the marketplace, especially output from the source market will play a crucial role on which destination will perform better than the other in the coming years. Destination marketeers and policy makers must understand that what they do in 2023, might no longer work from this year onwards, as the travel market shifts expeditiously while consumer buying power depends very much upon user-generated content (UGC). In this regard, understanding the PATA forecast report, which takes into consideration various key factors such as economic indicators, travel capacity, etc., will be crucial.”